Paying a bill should be simple. But in commercial real estate, it rarely is.

Processing a single supplier invoice might sound trivial until you’re juggling 40+ properties, each with different ownership entities, utility meters, tax jurisdictions, and tenant recovery rules. What should be a click-and-pay task turns into a high-stakes compliance exercise.

Like when a $239 water bill meant for Building B accidentally gets coded to Building D. Suddenly, a tenant dispute erupts over CAM charges, the monthly reconciliation is off, and your finance team is knee-deep in spreadsheets trying to unwind a single misapplied charge.

In commercial real estate, paying a bill isn’t just a click-and-pay task, it’s a multi-entity, compliance-sensitive, GL-coded balancing act. According to Ardent Partners, the average cost to process an invoice is $9.87. But for real estate finance teams, the true cost is often much higher because each invoice must be accurately coded to the correct:

- Property

- GL account

- Budget line item

- CAM recovery schedule

- Tax and regulatory category

Even a small error like applying a utility charge to the wrong building or skipping a tenant pass-through can lead to discrepancies in reconciliations, delays in payment, and even tenant escalations during CAM true-ups.

When Volume Breaks the Workflow

For midsize REITs and property operators, invoice volume is a major pain point. It’s not uncommon to process 50,000+ invoices per year across categories like:

- Utilities (gas, electricity, water)

- HVAC maintenance and repairs

- Insurance and legal services

- Landscaping, snow removal, and property upkeep

- Common area maintenance (CAM) and tax reconciliations

The Institute of Financial Operations & Leadership found 60% of AP teams are still manually keying in invoices, leading to challenges due to delays from invoice exceptions and data discrepancies.

Even small inefficiencies in invoice processing can create significant friction:

- Missed cut-off dates leading to late fees

- Interrupted vendor services

- Cash flow forecasting challenges

- Broken audit trails and compliance gaps

Compliance Makes It Even Trickier

Beyond high volume, real estate accounts payable (AP) teams must navigate a web of compliance and documentation requirements, including:

- W-9 collection and vendor tax ID tracking

- Lien waiver management for contractor payments on capital projects

- Energy benchmarking and sustainability disclosures, which vary by city, state, or building size

- Vendor onboarding, including license verification and insurance compliance

- Escrow and retainage tracking for construction or improvement invoices

- Multi-jurisdictional tax coding and real estate-specific regulatory filings

That’s a nightmare for controllers and finance teams trying to maintain audit readiness, predict cash flow, and ensure timely payment, all while staying compliant across a complex portfolio.

Unity Smart Payables: Built for Real Estate Complexity

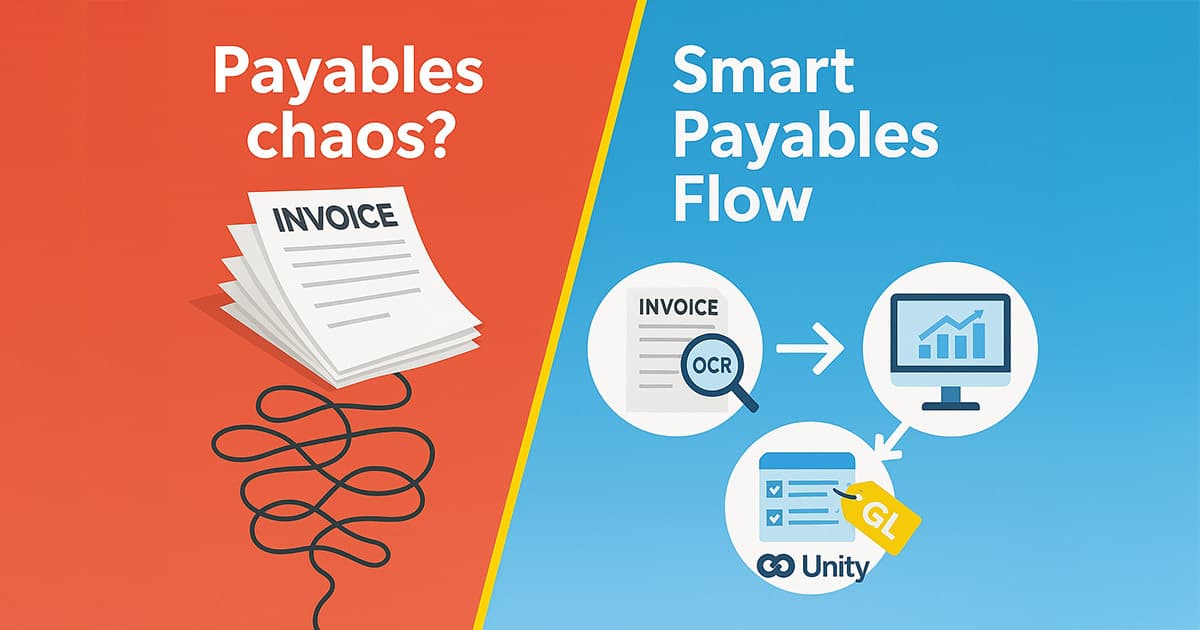

In commercial real estate, accounts payable isn’t just about paying bills it’s about managing complexity across multiple properties, entities, tax codes, and tenant arrangements. That’s why Unity Smart Payables was built specifically for real estate finance teams, not generic AP departments.

It combines intelligent invoice OCR with automated GL matching so you can simplify operations without sacrificing control or compliance.

Invoice OCR Built for Real Estate

Forget manual data entry. Unity Smart Payables extracts information from scanned invoices, utility bills, maintenance contracts even low-quality PDFs with precision. Whether you’re processing HVAC repairs or landscaping invoices, our invoice OCR for real estate ensures clean, structured data ready for approval.

Auto-Matching and Coding

After being ingested, the bills can then be auto-coded within Unity’s smart-tables, matching across key metrics:

- Property or building

- General ledger (GL) code

- Budget line or cost center

- Tenant chargeback or CAM recovery schedule (if applicable)

This eliminates errors in GL coding and significantly reduces time spent on manual allocation.

Batch Payments + Real-Time Cash Forecasting

Pay vendors by batch, entity, or region with confidence. Combine this automated workflow with Unity IQ’s visualization and reporting dashboards, and REIT controllers and CFOs can get a real-time view of payables exposure, helping you:

- Avoid late fees

- Improve vendor relationships

- Plan cash flow across your portfolio

Why It Matters for REIT Controllers and Property Finance Teams

With Unity Smart Payables, you can:

- Pay vendors on time, every time

- Eliminate lost invoices and approval delays

- Accurately allocate charges across buildings and tenants

- Gain full visibility into cash flow, payables aging, and compliance status

The result?

Scalability without chaos. Automation without risk. Compliance without bottlenecks.

Ready to Streamline Real Estate AP?

Discover how Unity Smart Payables can help your real estate finance team:

- Reduce manual workload

- Automate invoice processing

- Maintain control across complex portfolios