Each year, the real estate industry enters planning season with the same question: Where is the market heading next?

Newly released 2026 outlook reports from Colliers, Deloitte, Avison Young and others paint a clear, unified picture: the real estate sector is entering a period defined by uneven recovery, capital selectivity, and rapidly accelerating technological change.

But across all the analysis, one theme stands above the rest:

Real estate firms without a clear AI strategy risk falling permanently behind.

As Colliers noted in its recent outlook, the “AI productivity gap” is widening, and organizations that operationalize AI inside their workflows are outpacing those who stay in pilot mode. Deloitte’s 2026 survey of 850+ CRE executives shows the same tension: optimism persists, but hesitations are rising around costs, capital availability, and operational complexity.

Below, we break down the biggest trends expected to shape 2026 and why technology adoption, not experimentation, will define who wins.

1. Macro Volatility Pauses the Recovery — But Doesn’t Derail It

Deloitte reports that overall CRE sentiment dipped slightly from 2025 but remains solidly optimistic, with revenue expectations still elevated even as cost pressures rise.

Leaders cite the same top risks as last year:

- Capital availability

- Elevated interest rates

- Cost of capital

But two shifts stand out:

- Cyber risk fell dramatically as a concern, suggesting that firms have adapted or deprioritized it relative to more immediate financial pressures.

- Employee retention rose in concern, reflecting hiring stagnation and rising wage competition.

Avison Young’s 2026 report echoes this sentiment, noting that the most resilient firms are not those avoiding risk, but those reallocating capital with precision and leaning into operational efficiencies.

Takeaway

The market isn’t broken — it’s bifurcated. The winners will be those with flexible capital strategies and high-operating leverage, a reality that makes AI-driven process automation even more strategically valuable.

2. Investment Capital Is Selective — But Searching for Yield

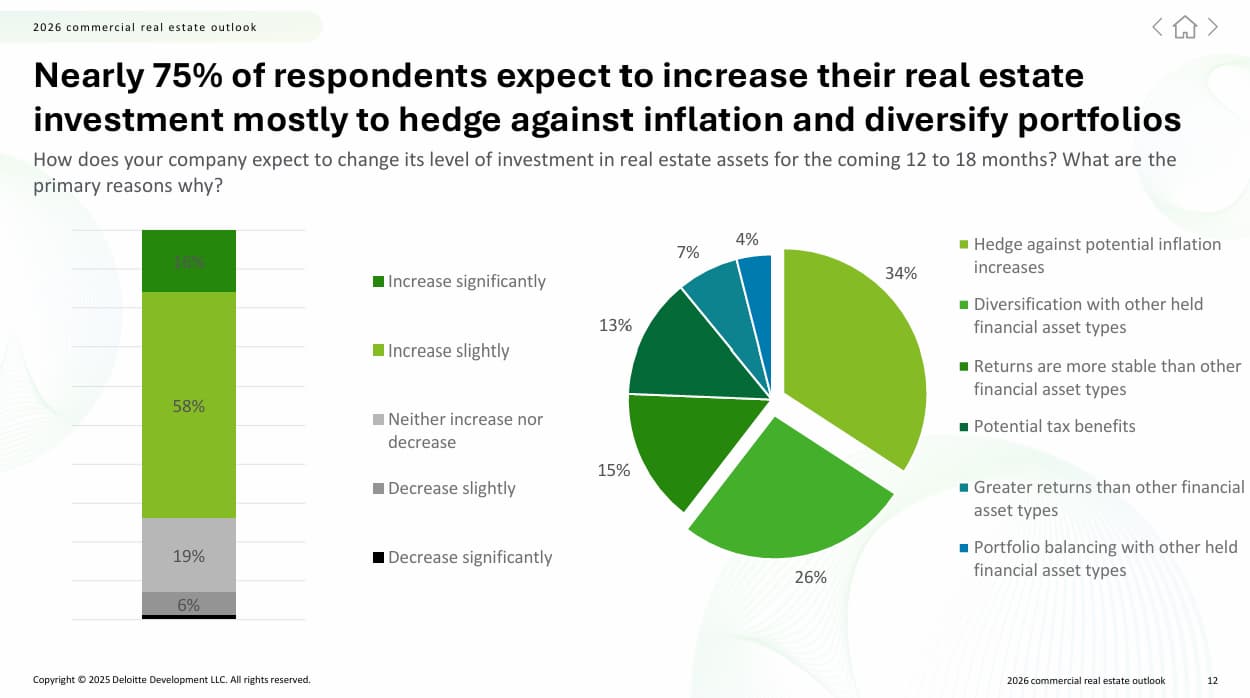

Nearly 75% of global CRE leaders plan to increase investments over the next 12–18 months, largely to hedge inflation and diversify portfolios, according to Deloitte’s survey results .

Across markets:

- Digital economy real estate (data centers, towers) retakes the #1 spot for investor interest.

- Industrial and logistics remain core, though supply chain uncertainty is reshaping demand.

- Office assets show signs of stabilization, aided by minimal new supply and a flight to quality.

Avison Young highlights that institutional capital is increasingly shifting toward alternative assets — student housing, life sciences, specialty logistics — while gateway office and retail remain situational bets.

Takeaway

2026 will reward allocators who balance defensive positioning with targeted growth bets — especially in asset classes tied to digital infrastructure. AI is central to making those underwriting decisions with better data and faster insights.

3. Debt Markets Are Splitting in Two

The 2026 environment is increasingly a story of legacy distress vs. attractive new originations.

Deloitte finds that:

- Over 50% of CRE organizations face loan maturities in the coming year, with only 21% expecting to pay off loans in full.

- “Extend and pretend” remains widespread, but lenders are slowly returning, and underwriting standards are easing.

- Alternative lenders now supply 24%+ of U.S. CRE debt, far above historical averages.

Many loans written during the ultra-low-rate era will face valuation resets or restructuring. But new loans, priced at today’s cleared cap rates and debt costs, are coming to market with healthier fundamentals and stronger risk-adjusted profiles.

Takeaway

Operational efficiency becomes a competitive differentiator: organizations with clean financials, predictable expenses, and reliable reporting will have an easier time refinancing and raising capital. This is where AI-powered AP, invoicing, and expense classification systems drive real value.

4. Alliances and Joint Ventures Become Essential for Scale

Both Deloitte and Colliers note that CRE is becoming a scale-driven business, with firms actively pursuing:

- Operating partnerships

- Cross-border alliances

- Joint ventures for specialized asset types

- Multi-asset platform partnerships

Large institutions (pension funds, sovereign wealth funds) increasingly want operating expertise plus technology maturity. According to Deloitte’s data, 24% of large firms seek JVs primarily to access property types requiring specialized knowledge — while smaller firms partner to enter new geographies .

Takeaway

Partnerships are shifting from capital-only to capability-sharing alliances, where data, technology readiness, and workflow modernization matter as much as capital commitments.

5. AI Maturity, Not Experimentation, Will Define 2026’s Top Performers

This is the most consistent theme across all reports.

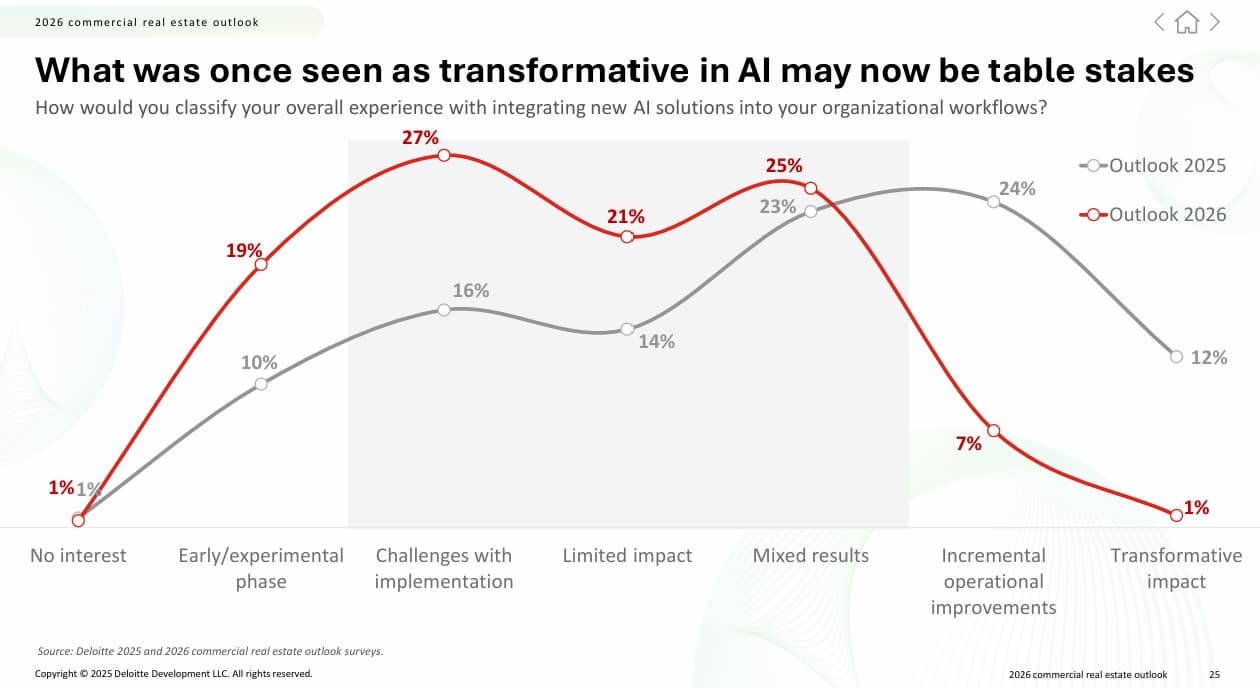

While interest in AI remains high, the tone has shifted from “transformative hype” to pragmatic implementation. Deloitte shows that:

- Only 1% report “transformative impact” from AI today (down from 12% last year).

- 27% cite implementation challenges.

- A growing share is turning to industry-specific platforms rather than building models in-house .

At the same time, adoption is accelerating in targeted areas:

- Tenant relationship management

- Lease drafting

- Portfolio analytics

- Property operations and alerts

We agree, consistently finding that firms who are actively deploying AI into AP, invoicing, collections, and contract workflows are already outperforming their peers. The productivity gap is visible — and widening.

Why this matters:

Real estate is still early in its AI journey, but the operational use cases are now proven, repeatable, and ROI-positive.

Organizations that move from pilot → platform → full operationalization will:

- Reduce cycle times

- Improve forecasting accuracy

- Lower error rates and leakages

- Support more assets with the same headcount

- Strengthen data quality for portfolio decisions

2026 Will Be a Sorting Mechanism

Across all leading reports, the message is clear: 2026 is not a year of dramatic rebound — it is a year of divergence.

Firms that modernize workflows, deploy AI at scale, and strengthen data discipline will accelerate ahead. Those that wait for “certainty” may discover that the gap has already become too wide to close.

Real estate has entered the era where operationalizing AI technology is crucial for strategy. The good news? It is not too late to find quick-wins with low-lift operational-ready AI solutions. Contact us to find out how we can help.