Real estate Chief Financial Officers (CFOs) are operating in an environment marked by unprecedented economic and operational headwinds. Rising interest rates, persistent inflationary pressures, and unpredictable cash flow challenges are forcing a re-evaluation of every financial process. Against this backdrop, the traditionally cumbersome and slow accounts payable (AP) cycles in the real estate sector are no longer sustainable. They exacerbate cash flow issues, strain vendor relationships through delayed payments, and obscure the real financial health of properties and portfolios.

This blog post will delve into these critical pain points, highlighting why real estate CFOs are making AP automation a top priority. We will explore how automation specifically reduces processing time, improves vendor satisfaction, and enhances forecasting accuracy, reflecting broader industry insights while demonstrating how StackDC’s Unity platform provides targeted solutions to these exact challenges across diverse real estate portfolios.

The Economic and Operational Headwinds Facing Real Estate in 2026

The real estate industry, while resilient, is not immune to broader economic forces. For 2026, several factors are creating challenges for CFOs:

- Rising Interest Rates: The era of ultra-low interest rates is largely over. Higher borrowing costs directly impact property development, acquisitions, and refinance strategies, leading to increased capital expenses and tighter margins. This necessitates meticulous cash flow management and cost control.

- Inflationary Pressures: The cost of materials, labor, and services continues to climb. This directly inflates operating expenses for property management and development projects, putting immense pressure on budgets and requiring precise tracking of every expenditure.

- Cash Flow Challenges: The cyclical nature of real estate, combined with delayed rent collections, tenant turnovers, and large capital outlays, often leads to unpredictable cash flow. CFOs need real-time visibility and agile control to manage liquidity effectively.

- Delayed Vendor Payments: Manual AP processes are notorious for causing payment delays. In real estate, this can mean overdue contractor payments, slower procurement of crucial supplies, and ultimately, strained relationships with essential vendors and service providers. This can lead to less favorable terms or even a reluctance to work with a particular firm, impacting project timelines and costs.

- Fragmented Operations: Real estate firms often manage dozens or hundreds of properties, each with its own set of invoices, expenses, and localized vendors. This highly fragmented operational structure leads to a deluge of paperwork, reconciliation nightmares, and a lack of centralized oversight.

These challenges collectively underscore the urgent need for real estate CFOs to transform their financial operations. The traditional manual approach to accounts payable, which can cost on average $10-15 per invoice and involves significant staff time, simply cannot keep pace with the demands of a high-pressure, high-volume industry like real estate.

Why AP Automation is No Longer a Luxury, But a Necessity

AP automation directly addresses these pain points by digitizing and streamlining the entire invoice-to-pay lifecycle. It’s a strategic imperative that helps CFOs pivot from reactive problem-solving to proactive financial management.

1. Drastically Reducing Processing Time and Costs:

Manual processing of invoices is incredibly time-consuming. From receipt and data entry to routing for approvals and eventual payment, each step is prone to delays. AP automation solutions use technologies like OCR and AI to automatically capture invoice data, match it against purchase orders, and route it for approval without human intervention.

- Impact on Real Estate: For a firm managing multiple properties, this translates into thousands of invoices processed significantly faster. Imagine reducing the average invoice processing time from days to hours. This efficiency directly frees up finance teams from repetitive data entry, allowing them to focus on more strategic analysis, budgeting, and financial planning for each property or portfolio. The cost savings per invoice can be substantial, directly contributing to the bottom line amidst rising operational costs.

2. Improving Vendor Satisfaction and Relationships:

Delayed payments are a major source of friction with vendors. In the real estate sector, maintaining strong relationships with contractors, suppliers, and service providers is crucial for project success and operational continuity.

- Impact on Real Estate: AP automation ensures timely and accurate payments. When vendors are paid reliably and on time, they are more likely to offer better terms, prioritize your projects, and provide higher quality service. This improves the supply chain, reduces the risk of project delays due to vendor disputes, and can even unlock early payment discounts, further optimizing cash flow. Happy vendors are also more likely to be repeat partners, contributing to long-term operational stability.

3. Enhancing Forecasting Accuracy and Cash Flow Visibility:

One of the biggest challenges for real estate CFOs is accurately forecasting cash flow. Without real-time insights into liabilities and expenditures, strategic decision-making becomes difficult.

- Impact on Real Estate: AP automation provides real-time visibility into all outstanding payables, commitments, and payment schedules across all properties and entities. This granular data enables much more accurate cash flow forecasting, allowing CFOs to:

- Proactively Manage Liquidity: Identify potential cash shortfalls or surpluses well in advance.

- Optimize Working Capital: Make informed decisions about when to pay invoices, taking advantage of payment terms and discounts.

- Strategic Planning: Allocate resources more effectively for future developments or property acquisitions.

- Budget Adherence: Monitor spending against budgets in real-time, identifying overruns quickly and enabling corrective action.

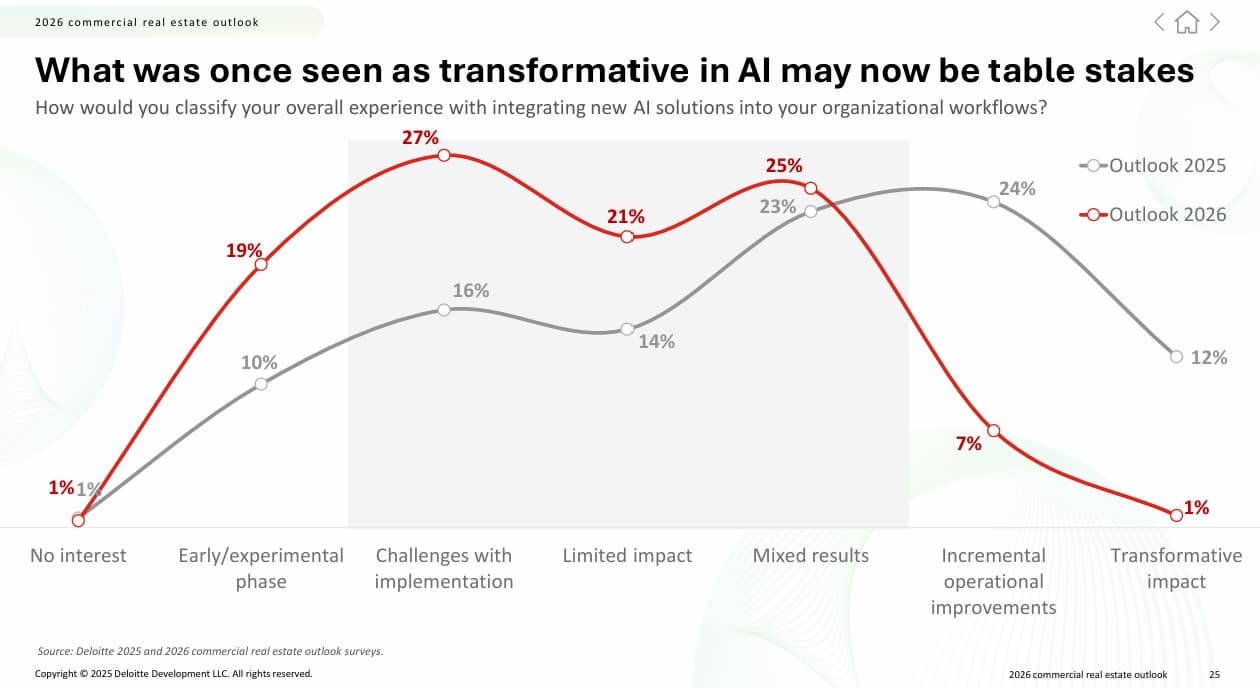

Reflecting Industry Insights: The CFO as a Strategic Visionary

Today’s CFOs are expected to be more than just “number crunchers”; they are strategic visionaries guiding long-term growth and maximizing ROI. The insights from leading financial experts, as seen in publications like Bottomline’s real estate blog and Forbes, consistently emphasize that automation is a top priority for CFOs going in 2026. They are looking for ways to do more with less, manage increased complexity, and leverage technology to gain a competitive edge. Accounts payable, while not always the most glamorous function, sits at the heart of cash flow, cost management, and operational risk. Automating this critical function empowers CFOs to move from transactional oversight to strategic leadership.

How StackDC’s Unity Platform Solves Real Estate’s AP Challenges

While many AP automation solutions exist, StackDC’s Unity platform is specifically designed to tackle the unique and complex challenges faced by real estate portfolios, building upon the foundational benefits of AP automation with advanced capabilities.

- Centralized Oversight for Fragmented Portfolios: Unity provides a single, unified platform to manage AP across multiple properties, entities, and business units within a real estate portfolio. This eliminates the fragmentation that often plagues real estate AP, offering a consolidated view of all liabilities and expenditures, regardless of their origin. CFOs gain unparalleled visibility into every property’s financial performance.

- Intelligent Invoice Processing Tailored for Real Estate: Unity’s AI-powered invoice capture and matching capabilities are trained to understand the nuances of real estate invoices, including complex contracts, varying payment terms for different vendors, and project-specific coding. This significantly reduces errors and ensures accurate allocation of costs to the correct property or development project.

- Dynamic, Location-Based Approval Workflows: Real estate requires highly flexible approval workflows that can adapt to different property managers, regional oversight, and central finance teams. Unity allows for the creation of dynamic approval matrices based on property location, invoice amount, vendor type, or specific project codes, ensuring that the right people review and approve invoices quickly and efficiently, minimizing delays.

- Enhanced Cash Flow Forecasting and Budgeting for Properties: By aggregating real-time data from all AP processes, Unity provides real estate CFOs with a powerful tool for cash flow forecasting at both the portfolio and individual property level. This allows for proactive management of funds, optimizing capital deployment, and ensuring projects stay within budget. It moves beyond just knowing what was spent to predicting when and where funds will be needed.

- Seamless Integration with Property Management Systems and ERPs: Unity is built for deep integration with existing real estate-specific property management software (PMS) and general ERP systems. This ensures a frictionless flow of data, maintaining data integrity and providing a holistic financial picture without manual reconciliation efforts. This connectivity is crucial for automating everything from lease-related expenses to maintenance contracts.

- Proactive Compliance and Audit Trails: For an industry under increasing scrutiny, maintaining meticulous records is vital. Unity provides comprehensive audit trails for every invoice and payment, simplifying compliance checks and providing transparency during audits. Its robust controls help mitigate fraud risks, a significant concern when dealing with numerous vendors and diverse payment flows.

- Scalability for Growth: As real estate firms expand their portfolios, Unity scales effortlessly. The platform is designed to handle increasing volumes of invoices and transactions without a proportional increase in manual effort, supporting sustainable growth and ensuring that AP remains an enabler, not a bottleneck.

Conclusion: A Strategic Imperative for 2026 and Beyond

The confluence of rising costs, slow payables cycles, and complex operational structures makes AP automation an undeniable strategic imperative for real estate CFOs in 2026. By embracing solutions like StackDC’s Unity platform, real estate firms can not only mitigate immediate financial pressures but also build a foundation for long-term growth and resilience.

The ability to dramatically reduce processing times and costs, cultivate stronger vendor relationships, and gain unparalleled visibility into cash flow and forecasting empowers CFOs to transition from operational oversight to strategic leadership. In a competitive market, where every dollar and every minute counts, optimizing the AP function with intelligent automation is not just a best practice; it is the pathway to sustained financial health and competitive advantage across the entire real estate portfolio.

The future of real estate finance is automated, integrated, and strategically driven, with platforms like Unity leading the charge.

Don’t let outdated AP cycles hold your growth hostage.

Automate, accelerate, and dominate your payables with Unity by StackDC — the platform built for real estate CFOs who mean business.

Talk to our experts today and experience next-quarter ROI, not next-year promises.